Investment Management Business

We provide investment management services and financial products to institutional investors, family offices, and high-net-worth individuals both domestically and internationally, leveraging our strengths in both traditional and non-traditional asset classes.

We also provide solutions to the growth challenges of domestic medium-sized and small businesses through our investment funds.

Through our group companies, we also provide support for business succession and business expansion into Asia.

Investment Management Services (*)

Provide not only financial products, but also exclusive investment services to domestic investors as well as overseas investors (business companies) that face difficulties accessing the Japanese market.

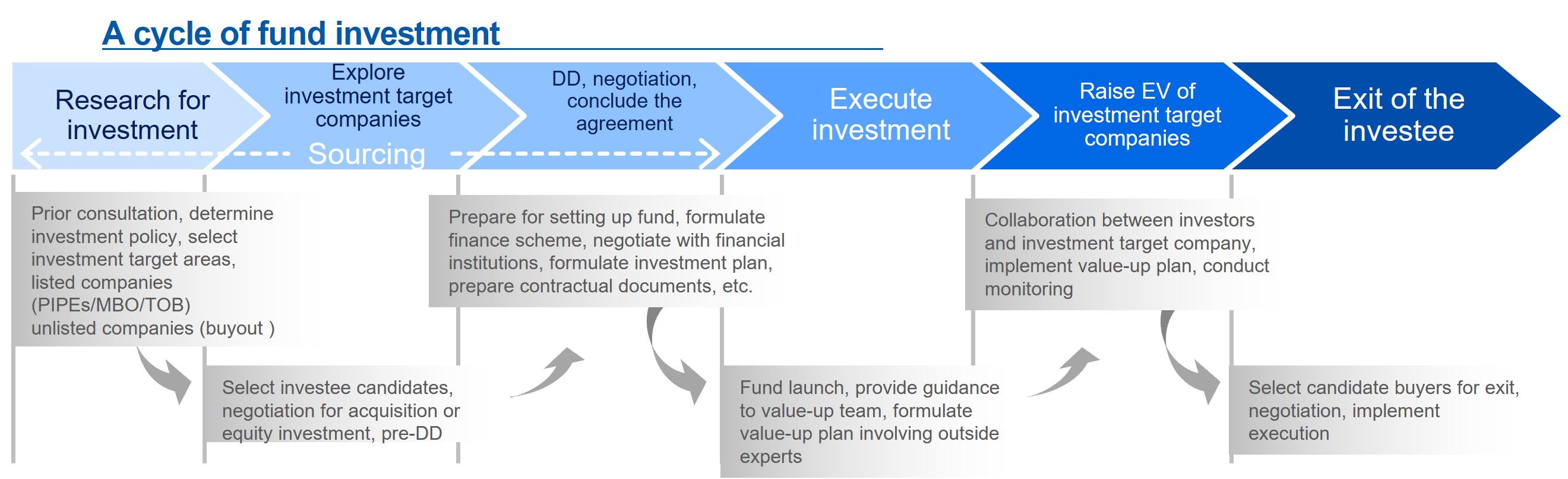

◆Cases where JAIC selects investee areas, companies and explores an investment target company; then taps multiple investors to form a private equity fund; and serves as the general partner (GP) for the fund

◆Cases where JAIC carries out sourcing, execution, value-up, and exit on behalf of the investors, on the condition that mainly unit investors and/or business companies will become co-investors or limited partners (LPs) (See chart below)

(*)Our group conducts fundraising and investment management as a registered operator under the Qualified Institutional Investor, etc. Special Business Exception, and provides services exclusively to investors who meet certain criteria, including qualified institutional investors.

Growth Support for Domestic Small and Medium-sized Enterprises

M&A fund

To help domestic medium-sized companies and startups to grow through M&As, we implement sourcing for investment opportunities, set up a private equity fund for each investment target, raise funds from external entities, and perform execution in line with their growth strategy.

RBO (Regional Buyout)

In this scheme, mainly on behalf of local companies that face unstable shareholder composition, fragile financial conditions, and a shrinking market due to the low birthrate/aging population, etc., we proceed with smooth delisting steps while protecting each company’s business continuity and consistency in corporate management, through sifting shareholders to local large companies, the upper management members, employees, the founder family, etc., as a final exit destination.

“RBO,” which means to ensure a buyout in the region, by the region and for the region. This scheme is proposed as JAIC’s unparalleled unique approach.

Buyout of a startup company

Through purchasing a substantial portion of the shares of each target startup company, we get involved in its corporate management and aim to help raise its enterprise value through hands-on support.

Business Succession Support

AJ Capital Co., Ltd. (AJC), a joint venture with Aozora Bank, runs business succession funds to help small and medium-sized business owners in Japan. These businesses are important for the local economy, and by supporting them, AJC contributes to the growth of Japan’s economy and the revitalization of local communities.

Succession Investment Limited Partnership, I

AJC creates capitalization strategy for small and medium-sized businesses struggling with a lack of successors and AJC invests in them through business succession schemes, individually tailored for each company. After investing, AJC provides various growth support measures to enhance the value of these businesses while solving issues related to business succession. So far, AJC has invested in 8 companies and exited 5 of them after successfully completed business succession.

Succession Investment Limited Partnership, Ⅱ

Following the investment policy of the first fund, AJC expands the range of target companies by using LBO loans and co-investment schemes. So far, AJC has invested in 4 companies.

For more details, please refer to website of AJ Capital Co., Ltd. (in Japanese).

Support for Business Expansion into Asia

Our subsidiary, Asian Market Planning Co., Ltd. (AMP), provides full-commitment support services for companies expanding into ASEAN markets.

Challenges of Expanding into ASEAN

・Demands, Competitors, and Industry Trends in the ASEAN Market

・Local Procedures

・Reliable Local Partners

・Adaptability to the ASEAN Market

・Review of Overseas Strategies Focused on Emerging Markets

Solutions provided by JAIC

・Support through the provision of advice and information

⇒ Formulation and advice on implementation plans for market research and market construction.

・Support through the introduction of management candidates

・Support for the development and training of personnel for global business

・Support for fundraising